Additional market factors to watch out for

Long-term, furnished rental inventory is increasing at a compounding rate, most likely due to AirBNB hosts converting their properties to long-term rentals. As traditional AirBNB bookings have grinded to a halt, owners are unable to keep short-term occupancy, and as their properties enter into the long-term rental market, they are actively creating a new class of competition for traditional apartment communities. Many of these listings are priced well within range of market rate apartments (and sometimes under), but offer condo-grade features and finishes.

We're watching this data closely and will provide more concrete information in a follow-up report.

Actionable Recommendations

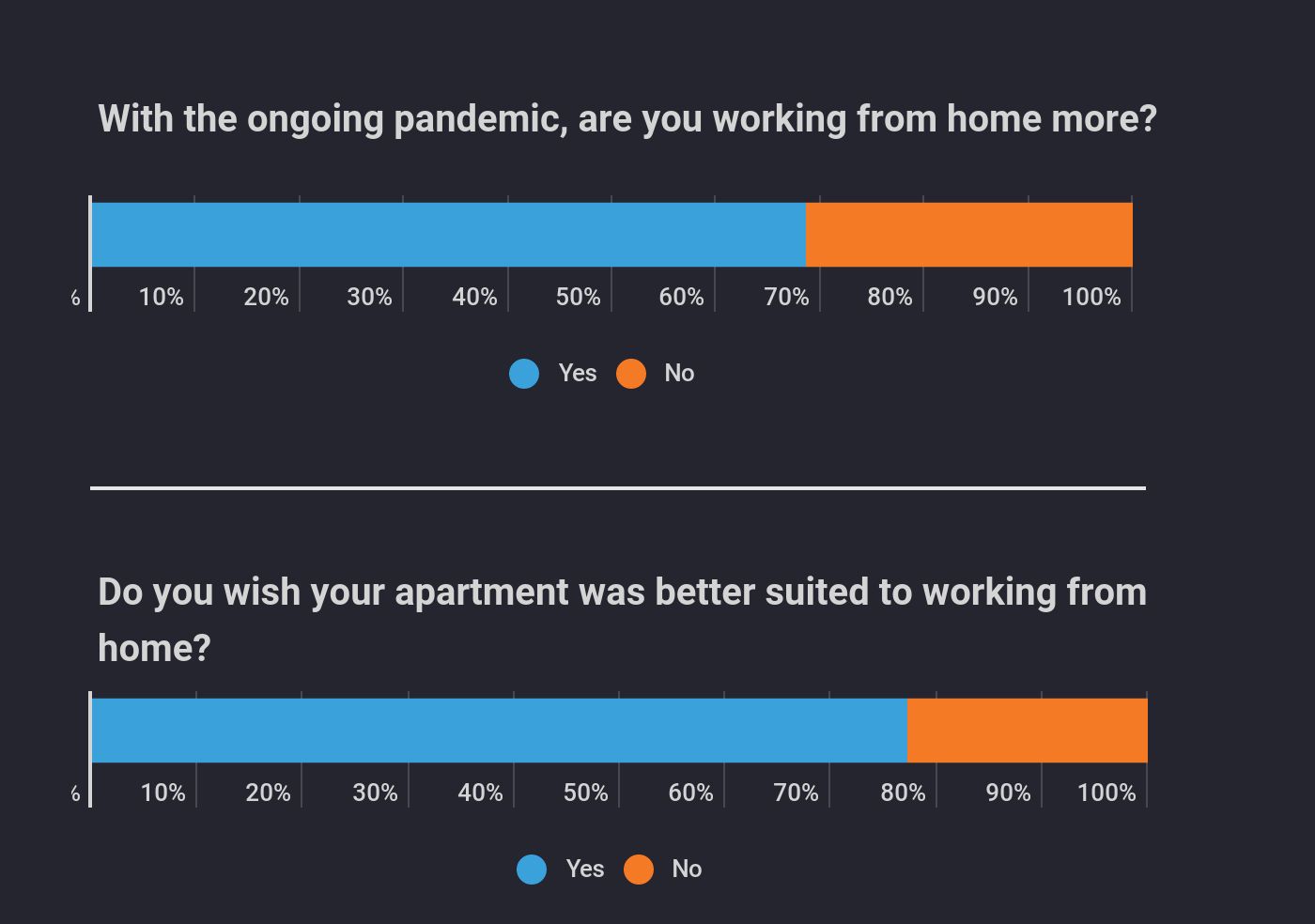

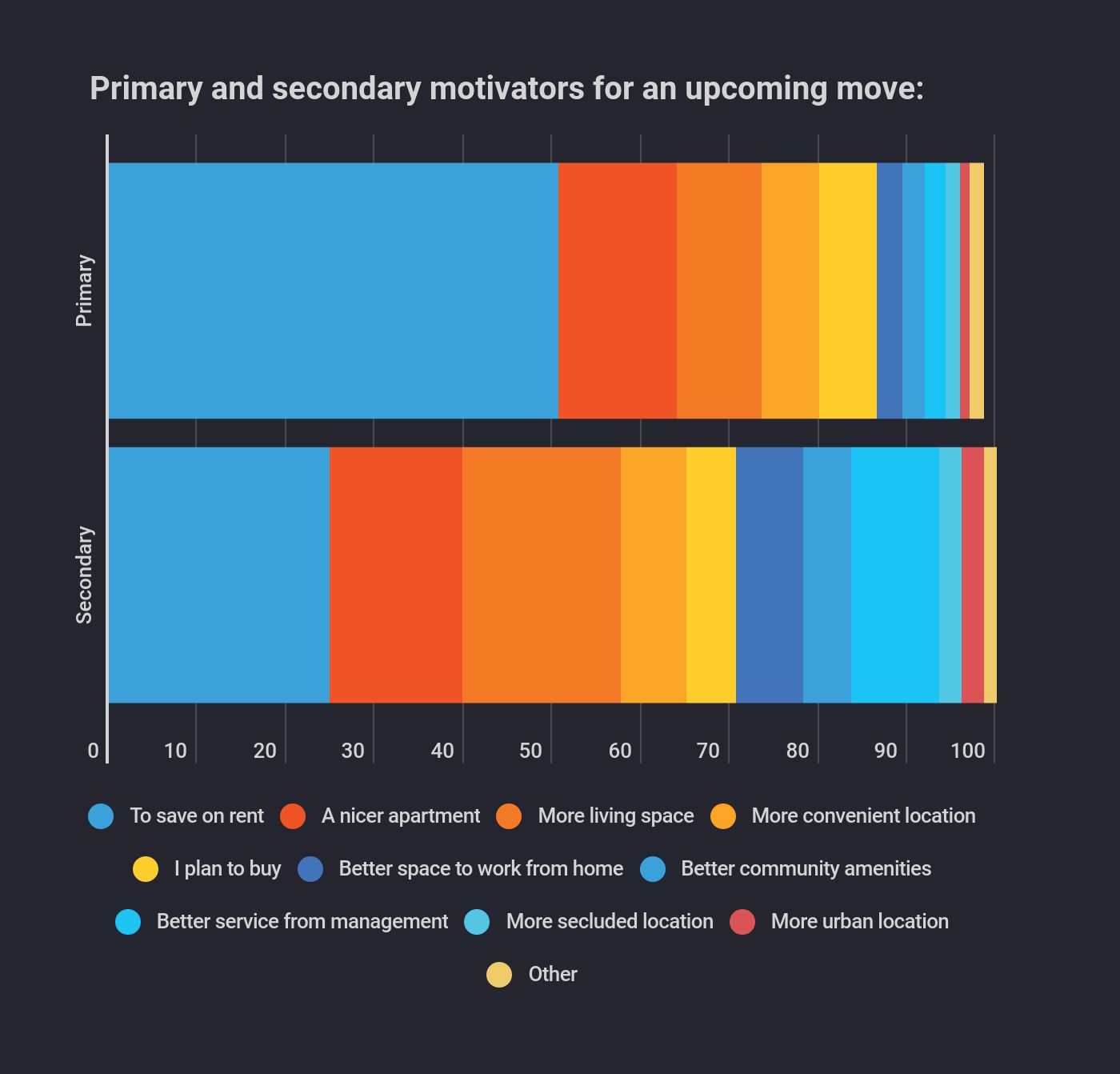

Working from home is a primary pain point for most renters surveyed. Gear your marketing toward the functionality of space, explaining specifically why your community is great for working from home.

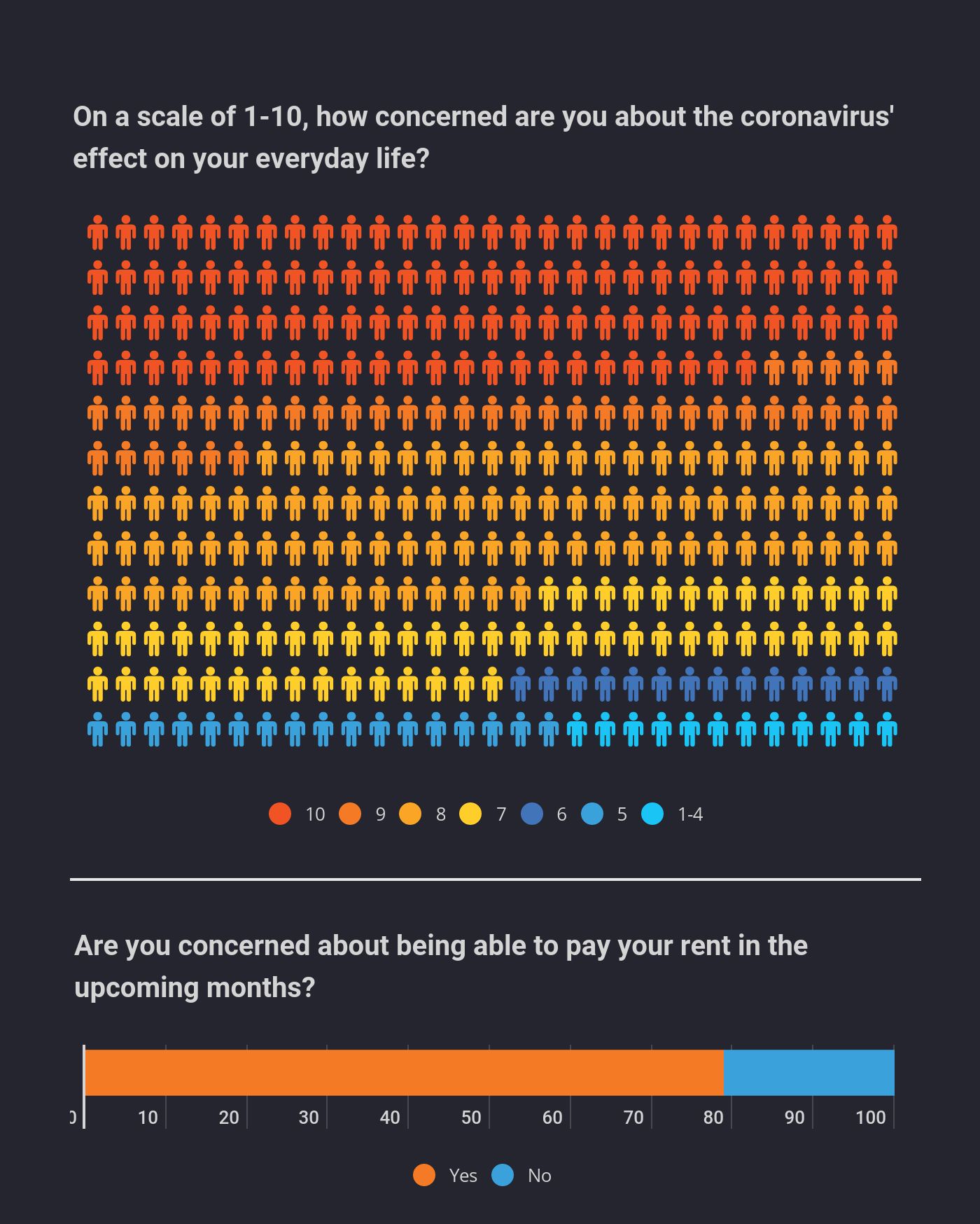

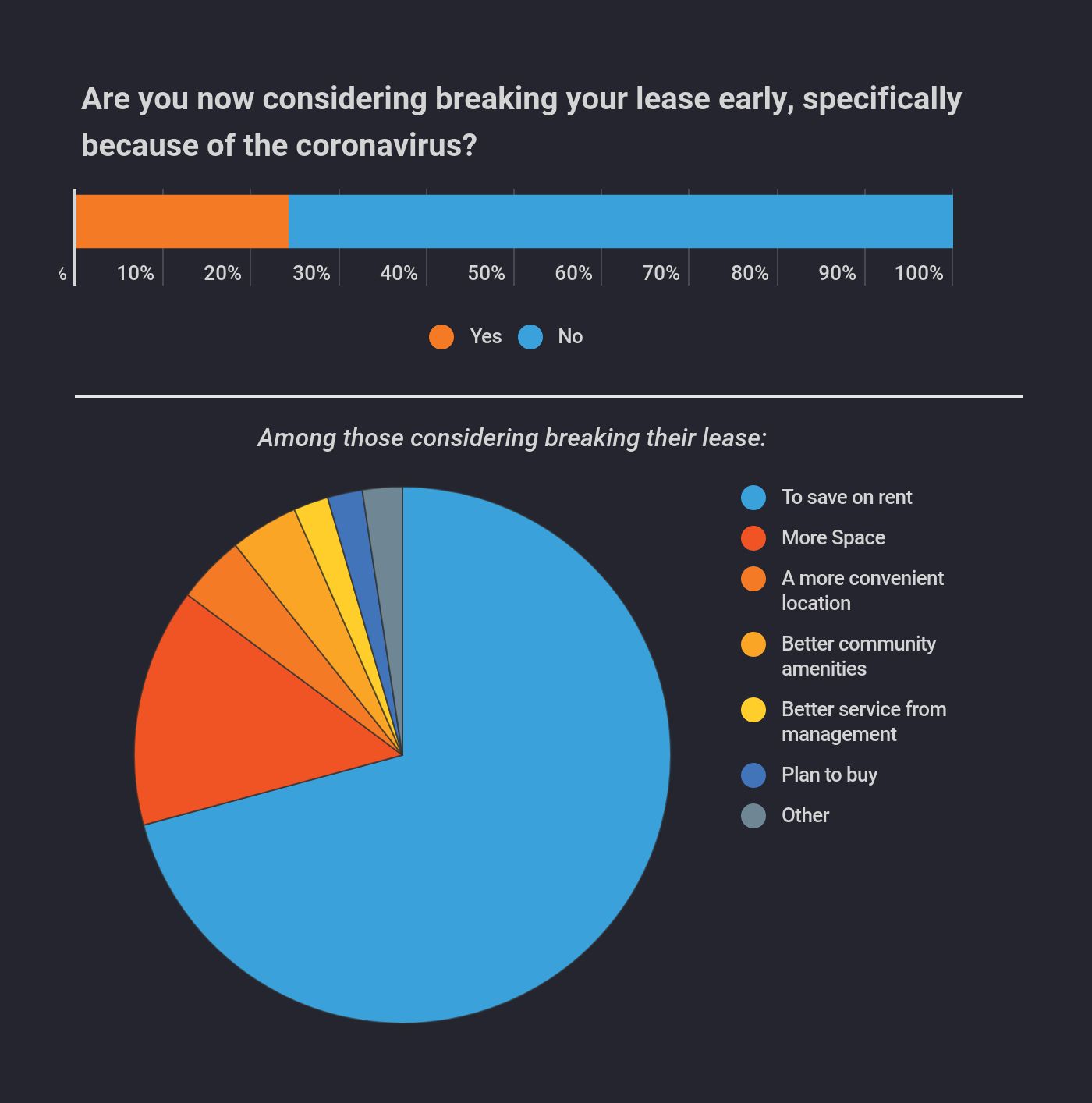

A huge number of renters are concerned about whether or not they’ll be able to afford rent with unknown upcoming effects on the economy, with 24% thinking about breaking their current lease. If you need to reach or maintain a certain occupancy level (read: everyone), you’ll need to get creative with your concessions.

Consider offsetting short term financial concerns with higher rent on the back end. Every property is different, but consider creating a version of these concession examples that work for you:

For new leases, 3 months free on a 15 month lease, with the back 12 months rent increased ~10% above the rent you need to charge for optimal NOI.

Be proactive in avoiding lease-breaks or evictions. Offer up to 6 months deferred rent for residents affected by COVID-19 with job loss or infection. Extend their lease by the same number of months, and increase rent by the appropriate amount. This also provides an excellent opportunity for positive PR, thereby potentially saving marketing dollars.

To win new prospects during a time of stay-at-home orders and social distancing, real 3D interactive virtual tours are far and away the best tool available. There is a lot of confusion among multifamily operators as to what constitutes a virtual tour, but the renter responses speak volumes. They want to be able to control the angle they're viewing, they want to be able to control where they 'walk around', and they don’t necessarily want to be on a 2-way video chat where they have to be on camera.

In addition to offering virtual tours whenever you can, there is still a subset of renters who like the idea of a video chat, but that number is higher when you use brand names like FaceTime and Skype instead of generic terms like video tour or video chat.